We all must have heard the term “Share Market”, “Stock Market” or in Hindi we call it “Share Bazaar”. Most of us might have a basic understanding of what it is or how it works. We all know that it is kind of a market where we invest some money and then after some time, we either get that back with surplus or negative. But only a few possess real knowledge about what the share market is. So, let’s understand it better. But before we do that let’s look back to its history as to how and where it all started.

History of Share market

The concept of share market started 400 years back, during the 1600s the then Dutch India Company used to send ships to travel and explore the world to find out new areas of land since as a world we still have not found our total mass area. As it was a very long journey (with multiple ships required) plus a lot of money was involved, so they decided to ask people to come forward and invest in our ships in return when they (DIC) visit the new land whatever they will get (maybe gold or other reserves) they shall give it back to those investors after they return to its homeland.

Slowly this concept gave rise, since as companies grow further they needed money, at the same time investors wanted to invest their own money in order to get higher returns.

Now let us understand what the stock exchange is.

The stock exchange is the place where people buy and sell shares of the companies. The market can be divided into 2 types i.e., Primary & Secondary market:

- Primary Market – In this market, the company comes forward and sells its shares in the market (called IPO), now it depends upon the company to decide what exactly would be their share prices. Not much can be manipulated by the company as it also depends upon the demand to some extend (so the company decides a price range). How much price are the people willing to pay for the company’s shares once the initial pricing has been set by the company.

- Secondary Market – In this market, once they (investors) initially bought the shares from the company, they can now buy & sell amongst themselves and trade in shares. Here, the company cannot do anything about its prices. This solely depends upon the demand and supply of the shares.

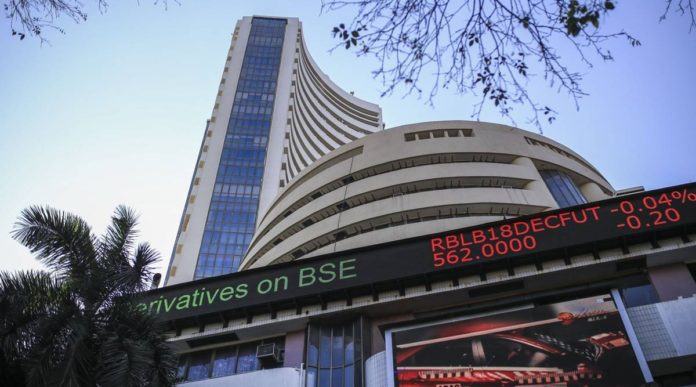

Examples of organized stock exchanges across the world – BSE (Bombay Stock Exchange, India), NASDAQ(USA), NYSE (New York Stock Exchange), SSE (Shanghai Stock Exchange), LSE (London Stock Exchange), etc

Another highlight of every share is listed on the stock exchange is that a company generally gives out not more than 50% of its shares to the general public. Since shares mean owners of a company, with more than 50% ownership given to the public then the authority or decision-making power will also be made by the public (or the investors of that company). So, in most of the cases company keeps at least 51% of its shares within itself so that the company has the decision-making power. For eg: Mark Zuckerberg CEO of FB owns 60% of its FB shares.

Given the understanding of primary & secondary markets, let us try to understand the functions of our Indian stock exchange.

What is the Indian Stock Exchange?

BSE & NSE are the 2 major stock exchanges in India. BSE has around 5400 registered companies whereas NSE (National Stock Exchange) that has 1700 registered companies. Now, If we want to observe whether the prices of the shares of the companies are moving up or down we can observe or rather measure it through SENSEX & NIFTY.

Let us understand a little about these 2 new terms SENSEX & NIFTY. SENSEX gives us the average trending numbers of the top thirty companies listed on BSE, whether it’s going up or down.

NIFTY (National Plus 50), it shows the price fluctuation of the share of top 50 companies listed on the NSE.

So, now as a company how does this entire process starts, what do we call it. Its commonly known as IPO. IPO (Initial Public Offering) is the term that we use whenever a company wants to start the process of selling its shares on the stock exchange for the 1st time, which can also be termed as “public listing”. Initially, this process was very simple, but nowadays it has become a lot complicated for its own good reasons. Because think about it, how easy it would be to scam the people. Anyone could get listed on the stock market with a fake company and exaggerate the value & achievements of its own company. They could lie to people & people would foolishly invest in his company. Then after taking the money (owner of the company) from the people, he could abscond from the company. Few examples of such scams are Harshad Mehta Scam, Satyam Scams, Ketan Parekh Scam to name a few.

So, in order to make the entire system scam-proof, a new regulator has been formed known as SEBI (Securities & Exchange Board of India) whose role is to monitor each movement and transaction made by such companies in the stock market. Now, in order to get listed in the stock market, a company has to fulfill each and every norm of SEBI some of them are as follows:

- There need to be a lot of checks & balances on the accounting of your company.

- At least 2 auditors must have had checked your company’s accounting.

- More than 50 shareholders should be pre-present in the company if you want a company to be listed publicly. This entire process takes more than 3 years.

- Also, even after all this. If SEBI feels that your company does not have the required demand to sell its share, then SEBI can remove that company from the stock market.

Once, the company has listed its shares in the market, how can we as an investor buy them and later sell that same share.

Before the internet came into India, this entire process of buying and selling used to happen inside the building BSE in Mumbai (then called Bombay), that too with simple pen and paper.

After the internet came into the picture, now the investor needs to do open these 3 things:

- Bank Account – This is required because we would need money to invest.

- Trading Account – This helps to allow us to trade and invest money in a company.

- Demat Account – It helps to store the stocks that we buy in a digital form.

In the share market another terminology that is been used the most is “Trading” and “Investing”, what is the difference between them:

- Investing means putting a certain amount of money in the stock market & letting it stay there for some time(at least till the time when we expect some returns)

- Trading means quickly putting in money at different places & withdrawing from some places. In-fact trading itself can be a full-time job. There are lots of people whose livelihood depends only on trading stocks in the market.

Now, the most important question, which we as a common man always fear before we think of investing in a share market i.e. Is the share market gambling? Or should we even think of investing our hard-earned money in the share market?

- In a practical scenario investing money in the stock market is a kind of gambling itself, especially if you are not aware of the type of the company and its performance, even its parameters, and the financial records.

- As an investor, if we do not observe its history & accounting information, then in a way this is a kind of gambling. Because we do not have any idea how that company will perform in future.

- We should never invest money based on what people are saying (which most people do nowadays), this is the riskiest affair.

- Its always better to rely on experts (traders) especially if we are a newcomer. Since the trader deals in stocks day in and day out. Investing our money with the help of their consultancy is always welcome.

Would like to end with a famous quote by Warren Buffet (CEO of Berkshire Hathaway)

- “Be fearful when others are greedy and be greedy when others are fearful.”

BY – Nilesh Dutta